The answer to that question isn’t “around here” unless you live somewhere like Shenzhen

By Gary S. Vasilash

Any new vehicle worth considering—or so it seems—has a gauge cluster and accompanying infotainment screen that brings to mind all of the digital signage in Harry Reid International Airport (formerly McCarran) in Las Vegas touting everything from tired rock acts (which explains why they’re in “residence” rather than on the road: they’re tired) to shows that you would want to see but would have a hard time explaining once you returned from that business trip.

Omdia’s Automotive Display Intelligence Service has calculated that in 2024 there were shipments of 232 million automotive display panel shipments, an increase of 6.3% over 2023.

The firm attributes much of the growth to demand in China.

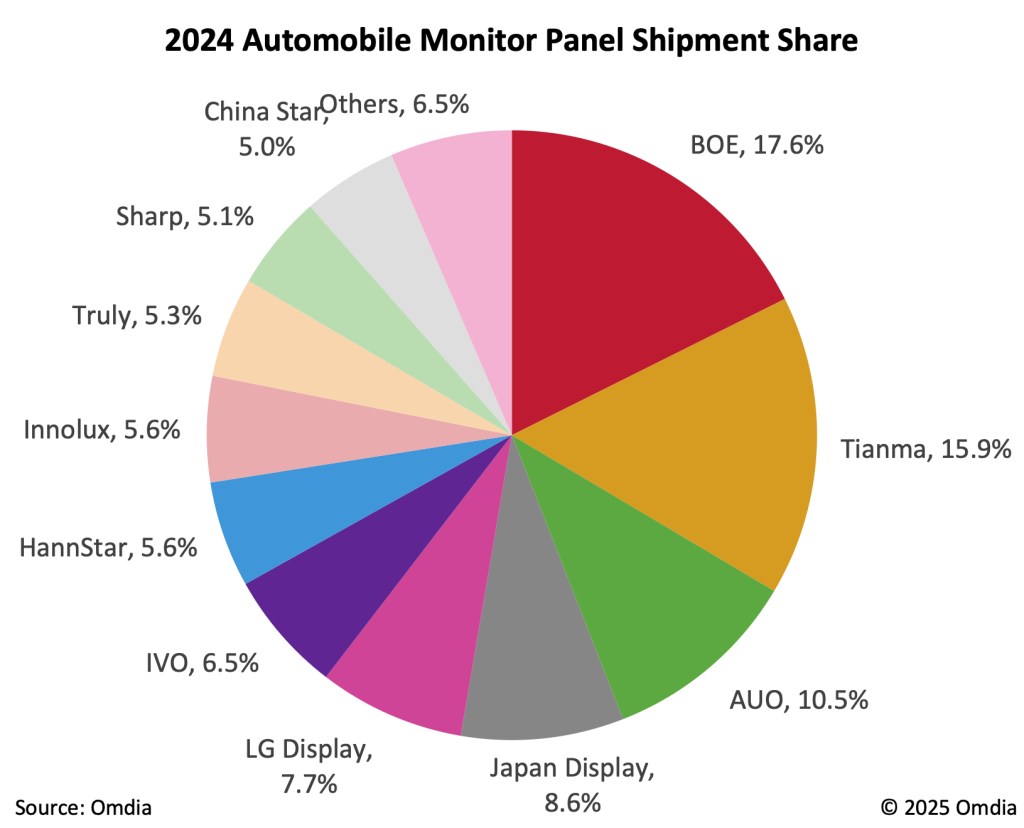

Speaking of which, it is surprising to see the companies that are global leaders in the auto display business: companies that you’ve probably not heard of.

The top producer is BOE, which had a market share of 17.6%. It shipped 40.9 million units.

It was followed by Tianma, with a 15.9% market share and shipments of 36.9 million displays.

A name with some familiarity, LG Display, was fifth, with a 7.7% share and 17.98 million shipments.

According to Stacy Wu, Omdia senior principal analyst, “Looking ahead, LCD fab capacity for automotive displays will become increasingly concentrated in advanced production lines, particularly G6 LTPS and G8 a-Si/Oxide fabs in China. While this shift enhances production efficiency, it also presents challenges in supply chain diversification as automakers and tier 1 suppliers navigate an increasingly complex global trade environment.”

Which probably means that the vast majority of displays used throughout the world come from China, and in places like the U.S., with the new tariff regime, they are likely to become increasingly expensive.

Enhanced production efficiency can get you only so far.