Well, optimism is always a good thing to have. . .

By Gary S. Vasilash

The Kerrigan Advisors 2025 OEM survey—which was conducted from December 2024 to March 2025, so it is pre-tariff—indicate that OEM execs are still bullish on the prospects for electric vehicles in the U.S. market.

Asked what their expectation is for EV market share by 2025—presumably that would be “by the end of 2025”—the largest cohort, 46%, answered 10% to 20%. While that bandwidth may have included a lot of 10%s and 11%, it still shows a certain sense of bullishness among these execs.

The second largest cohort, 40%, answered 7% to 10%.

So either way, there is a solid number of execs who see things growing, which is reasonable given the amount of new EVs that are being rolled out.

(The remaining 14% of respondents: 8% say 21% to 30% market share, 2% 31 to 40%, 3% 41% to 50%, and 1% greater than 50%. It would be interesting to know who that 1% is.)

That said, they are willing to admit that the EV transition isn’t happening as quickly as anticipated.

80% say that it is going slower than planned. 10% say faster than planned and 9% as planned.

Still, there is an evident stick-to-it-ness among the OEMs.

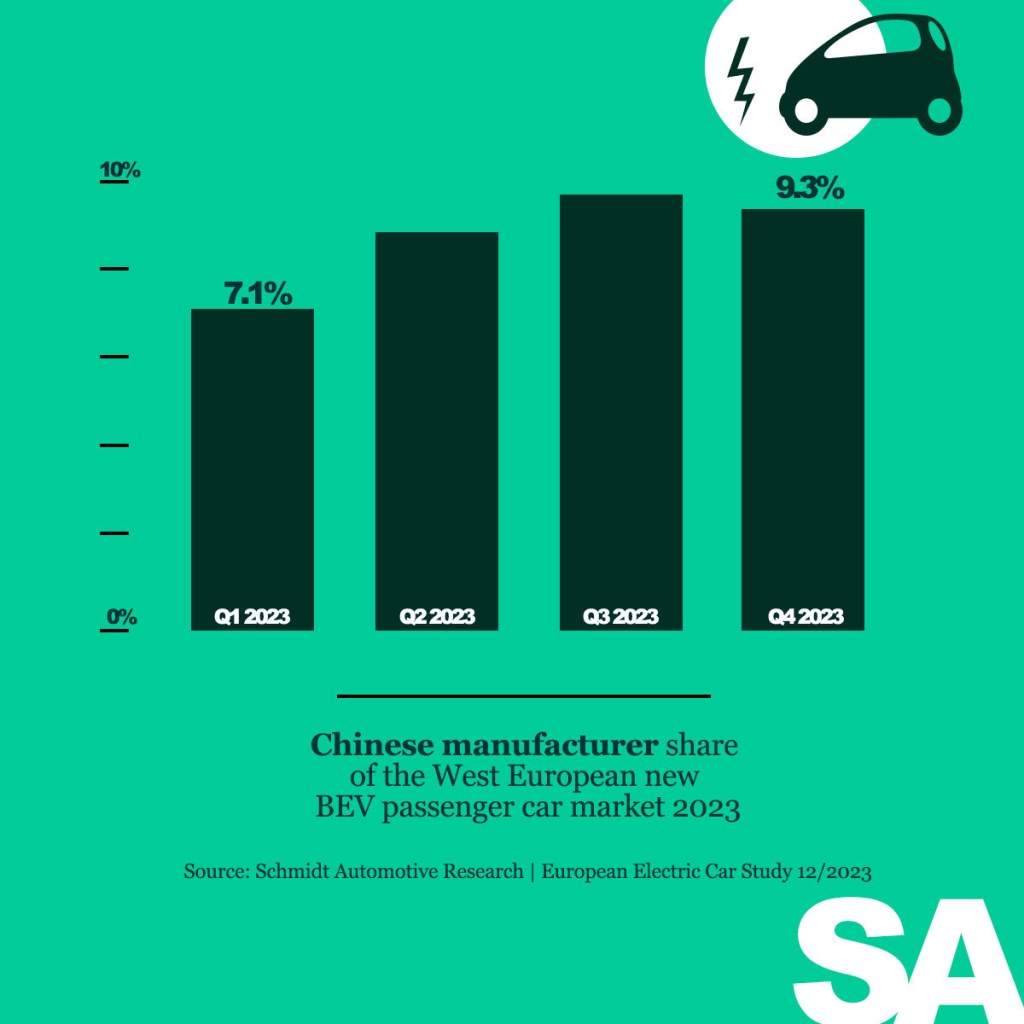

One question that might seem ominous—remember that in 2024 Elon Musk said that if Chinese EVs come into the U.S. market they would “pretty much demolish” U.S. OEMs—has it that 76% of OEMs “think Chinese OEMs will eventually enter the U.S. market.”

While “eventually” is possibly a long time, perhaps that recognition that it may happen will allow the U.S. OEMs to make the necessary countermeasures.