Roboshuttles are facing a challenging route

By Gary S. Vasilash

One of the issues related to things like roboshuttles, small bus-like vehicles that can operate autonomously, carrying, say, about a dozen passengers, vehicles that are often described as providing “last mile” transportation, is that for most people who need something for that last mile, as they’ve been needing it for a while they have undoubtedly figured out a method of accomplishing it.

It may not be the most efficient way, but it (a) works and (b) old habits die hard.

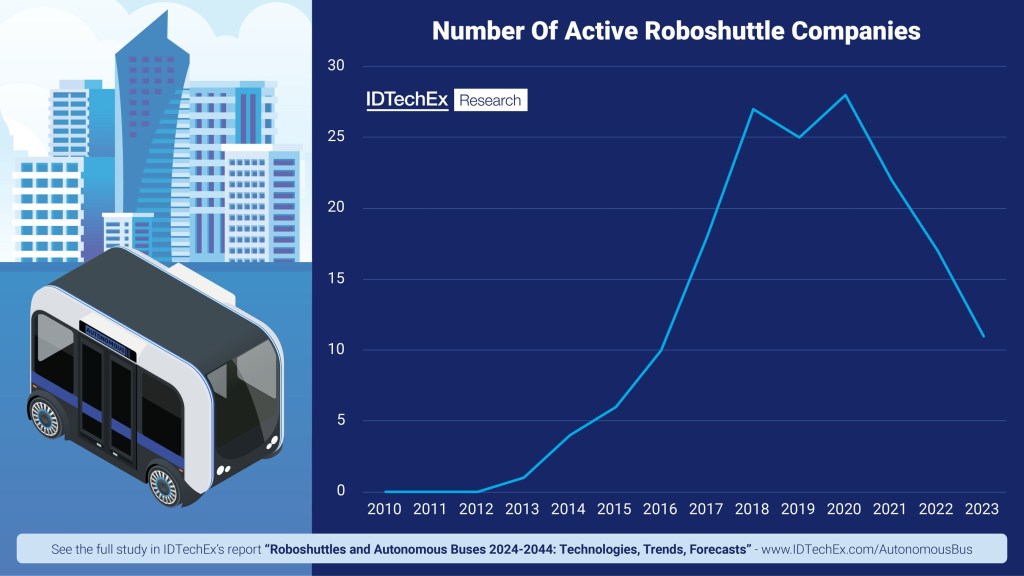

This could be one reason why research organization IDTechEx has found that between 2020 and 2024 the number of companies globally involved in the roboshuttle market went from 25 to 12.

A fairly sharp drop.

IDTechEX points out:

- Navya, which was a leader in the space, had some issues that led it to be acquired by two companies, one of which is likely to acquire the company that they’d relaunched from the Navya acquisition

- ZF has shifted from developing and building shuttles to producing hardware and software for autonomous operation; its shuttle business has been taken over by two other companies, Oceaneering and Beep

- May Mobility, which had been operating compact bus-like vehicles from Polaris GEM, is shifting to using Toyota Sienna minivans, just like the ones you can pick up from a local dealer (albeit without the autonomous capability that May adds)

As IDTechEX puts it, “The primary challenge facing the roboshuttle industry lies in the difficulty of finding practical commercial applications.”

Practicality and financial viability are two elements that cannot be underestimated.