While “ICE vehicle” sales may decline, this doesn’t mean the number of engines necessarily is going down

By Gary S. Vasilash

It seems that when people think about types of vehicles there are:

- Electric vehicles

- Hybrid vehicles

- Plug-in hybrid vehicles

- ICE vehicles

The categorization seems to overlook one big thing:

With the exception of the EVs, all of the other types include an internal combustion engine.

So when you hear that hybrids are up, this means ICE vehicles are up.

In providing his assessment of the vehicle market in Western Europe, Matthias Schmidt noted:

“12-month trailing data shows that new models featuring an internal combustion engine under the bonnet, be that a pure ICE petrol or diesel model, a mild (MHEV) or full (HEV) hybrid, or plug-in hybrid (PHEV), saw their combined share of the new car market rise upwards once again.”

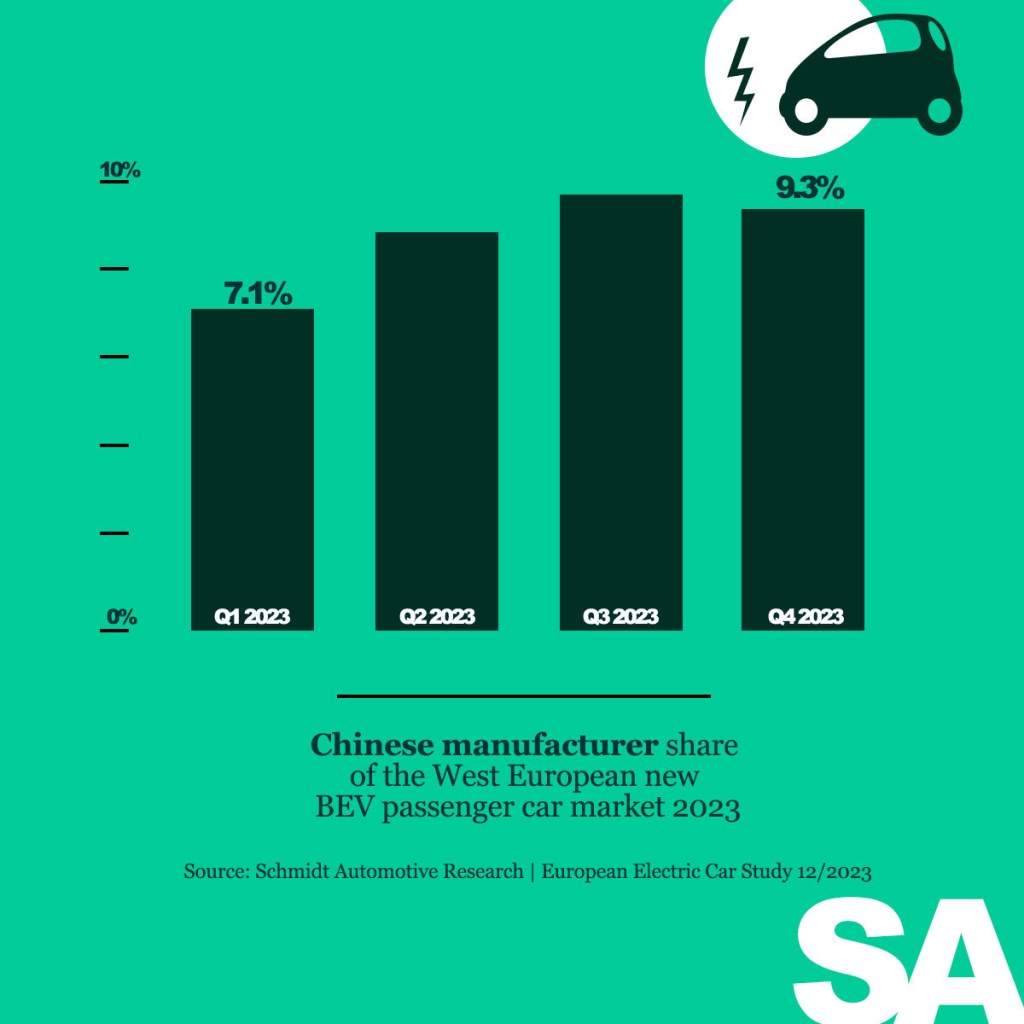

He also pointed out that EVs have been losing their spark in the Western European market, with, through May, three months of decline in a row.

According to Schmidt, “the most recent 12-month period data shows that between June 2023 and May 2024, the number of BEVs fell back to 1.97 million new units compared to 9.8 million other models.”

Other models that burn liquid fuel.